The New Energy Star 7.0 Tax Credit for Windows and Doors:

If you’re thinking about upgrading your windows and doors, now is the time to do it. The new Energy Star 7.0 Tax Credit for Windows and Doors can save you money on the cost of energy-efficient windows and doors, making it more affordable than ever to improve the energy efficiency of your home.

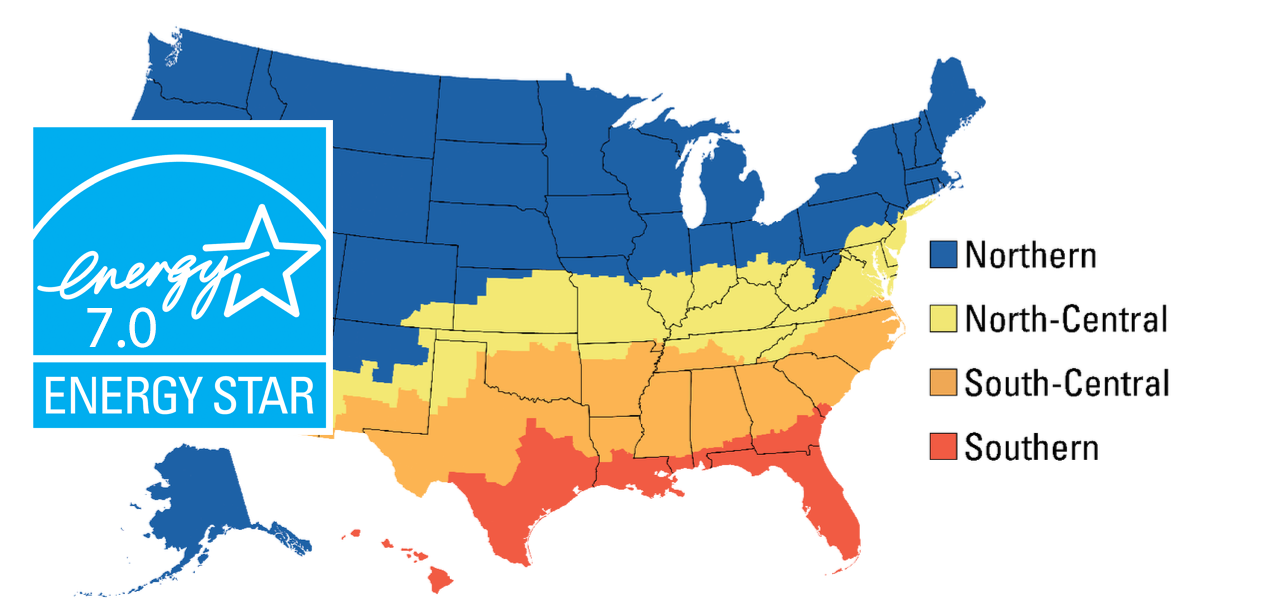

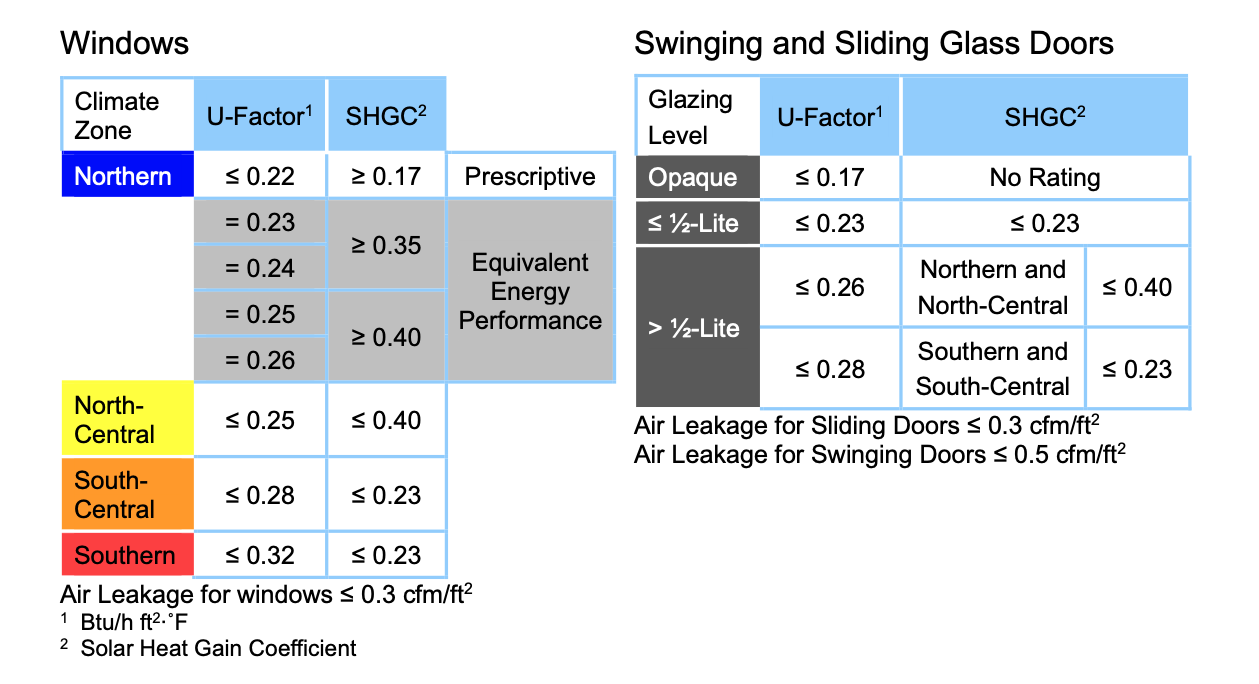

The Energy Star 7.0 tax credit for windows and doors program is a government-backed initiative that sets standards for energy-efficient products, including windows and doors. In order to qualify for the tax credit, the windows and doors you purchase must meet the Energy Star 7.0 requirements.

These requirements are based on the U-value, which measures the rate at which heat is transferred through a material, and the Solar Heat Gain Coefficient (SHGC), which measures how well a product blocks heat from the sun.

The Energy Star 7.0 Tax Credit for Windows and Doors is available for both new construction and replacement windows and doors. If you’re building a new home, you can claim the tax credit for all of the windows and doors that meet the Energy Star 7.0 requirements. If you’re replacing existing windows and doors, you can claim the credit for the cost of the new products, up to a certain amount.

The tax credit is available for both homeowners and businesses. For homeowners, the credit is equal to 10% of the cost of the windows and doors, up to a maximum of $600 for windows and $500 for doors. For businesses, the credit is equal to 10% of the cost of the windows and doors, up to a maximum of $1,500.

To claim the tax credit, you’ll need to file IRS Form 5695 with your tax return. You’ll need to have the required documentation, such as a Manufacturer’s Certification Statement for each product, to verify that the windows and doors meet the Energy Star 7.0 requirements.

It’s worth noting that this program has a expiration date, so it’s important to take advantage of this opportunity as soon as possible. So, if you’re planning to upgrade your windows and doors, be sure to consider energy-efficient options that meet the Energy Star 7.0 requirements and save money on the cost with the tax credit.

Overall, upgrading to energy efficient windows and doors can help you save money on your energy bills, improve the comfort of your home and decrease your carbon footprint, so it’s a win-win situation. Upgrade today and enjoy the benefits for years to come!

If your looking for products that qualify for the new Energy Star 7.0 Tax Credit for Windows and Doors please use our ClimaShield Glass package available on 8100 Series Windows, Casement Windows and Sliding Patio Doors